We have considerable experience across all aspects of the development process from site acquisition, financing, planning and construction through to letting and onward sale.

We have built up a strong track record through directly managing projects ourselves or working in joint venture with other development partners or occupiers. In the last 18 months we have completed over 250,000 sq ft of buildings.

Buccleuch is committed to a wide range of development opportunities, across sectors including industrial/logistics, healthcare and retail warehousing as we actively seek to expand our portfolio.

Currently, we have consent or allocations for over 3.5 million sq ft of commercial accommodation together with a long-term strategic land bank of approximately 12,000 housing units.

With exceptional access to development capital, we can pursue new opportunities to further our ambition to create high quality, sustainable buildings in keeping with the local environment.

Development Case Study 1

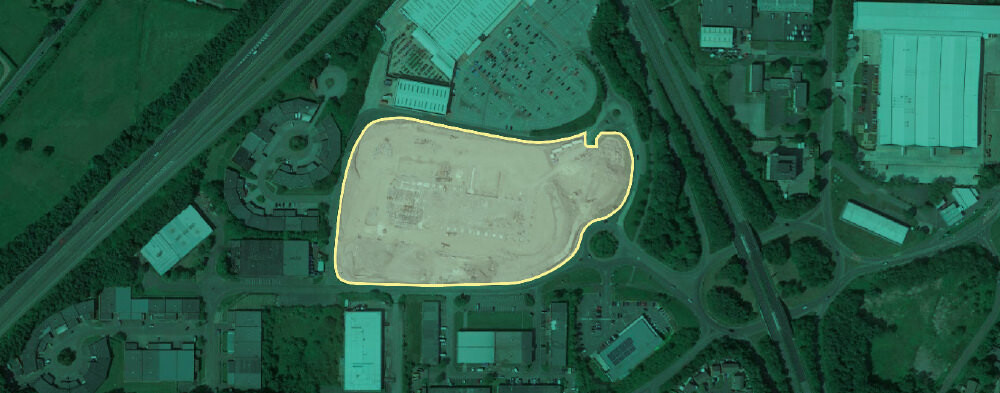

Buccleuch Property were appointed in May 2023 as Development Partners to Renfrewshire Council to advance and secure investment into AMIDS, a high-profile site neighbouring Glasgow Airport. Home to the University of Strathclyde-operated National Manufacturing Institute Scotland (NMIS) and the state-of-the-art CPI Medicines Manufacturing Innovation Centre, AMIDS will create an internationally recognised centre for advanced manufacturing, innovation and research.

Buccleuch Property will deliver future phases of development starting with a speculative Tech Terrace featuring a number of R&D units designed to cater to current SME demand. All development on AMIDS will meet Renfrewshire Council’s net zero carbon aspirations and already benefits from a district heating network.

Photo Credit: Imagery @2023 Airbus, CNES/Airbus, Getmapping plc, Infoterra Ltd & Bluesky, Maxar Technologies, The GeoInformation Group, Map Data @2023

£7.6m

investment in initial development phases

17,800 sq ft

start-up facility to be delivered

£39m

public infrastructure works in place

Development Case Study 2

In partnership with Wrenbridge Land, Buccleuch Property unconditionally purchased 1.9 acres of land at the Bridge, Dartford. Following the grant of planning consent, a speculative development totalling 41,500 sq ft of Grade A industrial space commenced and during the build period the project was let in its entirety to Network Rail on a 10 year lease.

The building was forward sold to Abrdn with the whole development from planning submission to completion and subsequent sale being achieved within 17 months of the initial site acquisition. The development won the Industrial Agents’ Society Best Development under 75,000 sq ft award in 2019.

Maps Data: Google, ©2022 Getmapping plc, Infoterra Ltd & Bluesky, Maxar Technologies, The Geoinformation Group, Map data ©2022

£2.46m

site purchase

£12.1m

Gross Development Value

4.25%

Yield

59%

Project Internal Rate of Return

Development Case Study 3

Buccleuch Property in conjunction with their development partner Argon Properties, acquired a brownfield site in Washington from B&Q for £1.6m. The land was promoted for commercial use following which terms were agreed with DPD to pre-let a new distribution warehouse.

Completed in January 2022, the whole development from planning submission to building handover was completed within fifteen months. The building was sold on completion to Abrdn with the balance of the site currently being marketed for commercial and roadside uses.

Maps Data: Google, ©2022 Bluesky, Getmapping plc, Infoterra Ltd & Bluesky, Maxar Technologies, The Geoinformation Group, Map data ©2022

£16m

Gross Development Value

4.05%

Net Initial Yield

125 jobs

created on site

25 years

lease term secured, previously vacant for over 25 years

Development Case Study 4

Kettering Business Park was identified by the Salvation Army Trading Company (SATCOL) as the preferred location for their new distribution and sorting centre. The project was time critical due to the lead in time for the mechanised fit out that SATCOL required to install. Despite construction commencing in Q4 2019, shortly before the start of the pandemic, the excellent working relationship established between developer, tenant and contractor ensured the building was completed in line with its original target date.

As part of the base build a substantial element of tenant fit out was also included which helped to streamline the operating timeframe for the building going live. The development was forward sold to CBRE Global Investors and subsequently nominated for the Industrial Agents’ Society “Best Development under 75,000 sq ft” at the 2020 awards.

Maps Data: Google, ©2022 Bluesky, Getmapping plc, Infoterra Ltd & Bluesky, Maxar Technologies, The Geoinformation Group, Map data ©2022

£9.5m

Gross Development Value

74%

Project IRR; 18 months from start to finish

35 acre

business park

Development Case Study 5

In conjunction with Wrenbridge Land, Buccleuch Property unconditionally purchased 4.5 acres of land in June 2019 which formed part of the Wixams mixed use regeneration project. Planning consent was obtained for a warehouse and distribution development with a pre-let for just under one third of the total space quickly being identified to help de-risk the delivery.

The project featured a focus on well-being with excellent environmental credentials including a dedicated onsite communal amenity area, secure bike storage and shower facilities within all the units. The project was forward sold to IM Properties.

Maps Data: Google, ©2022 Getmapping plc, Infoterra Ltd & Bluesky, Maxar Technologies, The Geoinformation Group, Map data ©2022

£2.95m

site acquisition

£13m

Gross Development Value

750 acre

Part of a 750 acre mixed use regeneration project

Development Case Study 6

In conjunction with Secklow Asset Management, Buccleuch Property unconditionally purchased 1.6 acres of land at Wolverton, Milton Keynes. The site came with the benefit of a detailed planning consent and following completion of the land purchase, construction work commenced immediately – which was the first speculative warehouse development of its kind in Milton Keynes in over ten years.

On completion, the property was let to Funrise International – a global innovator in the design, manufacturing and distribution of toys worldwide – and subsequently sold to the City of Norwich Council.

Maps Data: Google, ©2022 Getmapping plc, Infoterra Ltd & Bluesky, Maxar Technologies, The Geoinformation Group, Map data ©2022

£4.9m

Gross Development Value

5.11%

Yield

31%

profit on cost

1.6 acres

Development Case Study 7

Situated five miles south of Edinburgh city centre, Shawfair Business Park is Midlothian’s premier business destination. Major occupiers include the Scottish Qualification Authority and Spire Private Hospital with David Lloyd Leisure and Danfoss both recently committing to significant new developments.

Sustainability is at the heart of the Business Park which benefits from excellent connectivity to the City Bypass and from an onsite Park & Ride with frequent bus links to the city centre, along with a dedicated rail station providing a direct link to Edinburgh Waverley in under fifteen minutes. The Danfoss Low Carbon Innovation Centre is the company’s first carbon neutral building in the world and completed in January 2023.

Maps Data: Google, ©2022/CNES/Airbus,Getmapping plc, Infoterra Ltd & Bluesky, Maxar Technologies, The Geoinformation Group, Map data ©2022

£30m

Total investment to date

£20m

committed to further development

35 acres

of developable land

561

space Park & Ride on site

15 mins

journey time to Edinburgh Waverley

Development Case Study 8

In conjunction with Wrenbridge Land, Buccleuch Property have unconditionally acquired this prominent Oxford site in an established commercial location in the Cowley area of the City. The former gas holder, owned by Southern Gas Networks, has now been decommisioned and removed.

Parkway Construction have been appointed and are onsite delivering a 43k sq ft Hi Tech/R&D led building with a major emphasis on sustainability and meeting the highest environmental accreditations together with future occupational flexibility. Practical Completion is scheduled for January 2024. The scheme is being forward funded by IM Properties.

Maps Data: Google, ©2022/CNES/Airbus,Getmapping plc, Infoterra Ltd & Bluesky, Maxar Technologies, The Geoinformation Group, Map data ©2022

£2.26m

site price

£10.2m

total development costs

2.3 acres

Copyright © Buccleuch Property 2024

Site designed by ctdstudio and built by process production